New market opportunity: Payment orchestration

Payment orchestration for global e-commerce is expected to grow 20% YoY from 2021 to 2026. For any online business that needs to offer multiple payment options for customers worldwide, payment orchestration is a valuable service. If you’re new to this payment topic, keep reading to learn what payment orchestration is, the benefits of using this service, and how it works for businesses.

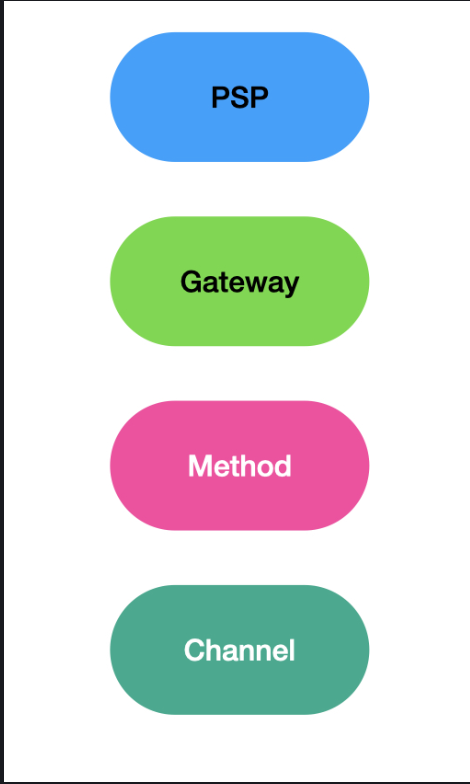

Terminology

For easier understanding, it's better to get some terms right.

Payment Service Provider(PSP): A payment service provider is a financial institution that enables an online transaction. It links merchants with card networks and payment processors for payment processing. A PSP provides a merchant account and payment gateway for the collection and management of payments.

Payment Gateway: Payment gateway is a software behind credit card transactions between a merchant and their customers. Upon entering the payment information on the merchant’s website, the payment gateway connects to the payment service provider to process the transaction.

Payment Method: This is how you choose to pay. Most popular methods are Credit cards, Debit Cards, Internet Banking, Paypal, e-Wallets etc

Payment Channel: This is the specific provider after you choose payment method. You'd probably choose Visa or Mastercard for card method, JP Morgan or HSBC for internet banking, AliPay or GrabPay for e-Wallets etc.

Merchants generally choose payment gateway for their PCI-DSS compliance to process/store customers' credit and debit cards. PCI-DSS offers certification in different levels called Level 1,2,3 etc - where Level 1 is most stringent. Abstraction

Different types of merchants use these PSPs, gateways, methods and channels in different combinations. For instance,

Hyperlocal merchants: They know exactly what methods are most popular in their country or city. They do direct integrations with some channels like Internet Banking and e-Wallets, thereby avoid payment gateway charges. Many merchants also don't want the engineering & regulatory complexity of payments and choose to go with gateways/PSPs for all payment methods and channels.

SaaS merchants: SaaS companies focus more on product, marketing and sometimes sell globally. Most SaaS merchants go for payment gateway who can support local payment methods, currency conversions, PCI-DSS compliance, subscription payments, invoicing etc

Cross country merchants(Airlines etc): Transaction volumes are pretty high with airlines and airlines generally offer local payment methods by partnering with local gateways or PSPs

Problem & Opportunity

Formal problem statement: Merchants rely on ONE PSP or gateway and spend internal engineering time/money/effort to maintain payments. In turn gateways charge merchants hefty price (generally x% per transaction).

Real problem statement: Payment transaction costs are day light robbery. Payment transaction costs go to payment gateway, issuing bank, acquiring bank. On top of this currency conversions, subscription payment charges, invoicing prices, fraud protection tools etc. If a merchant's margin is $15 for $100 transaction, there's a chance she might be paying $7.5 just to payment gateway.

Opportunity: Merchants have a real opportunity to:

- Integrate payment methods directly and increase bottom line. They can avoid paying payment gateways altogether.

- Offer more local payment methods and increase top line.

- For card payments, switch gateways based on pricing. Example: High number of transaction days(Sale, Christmas, Black Friday etc)

Challenge for merchants to do this by themselves is effort in engineering, time spent and they might loose focus on the actual product/service.

Enter Payment Orchestration Providers

But what is need for "orchestration"?

Like I mentioned, merchants often rely on one payment provider and this provider dictate transaction costs and it takes a lot of time and effort for merchants to move to a different gateway.

Payment orchestration platforms have chance here to:

- Integrate multiple payment gateways so merchants can pit payment gateways against each other for better pricing

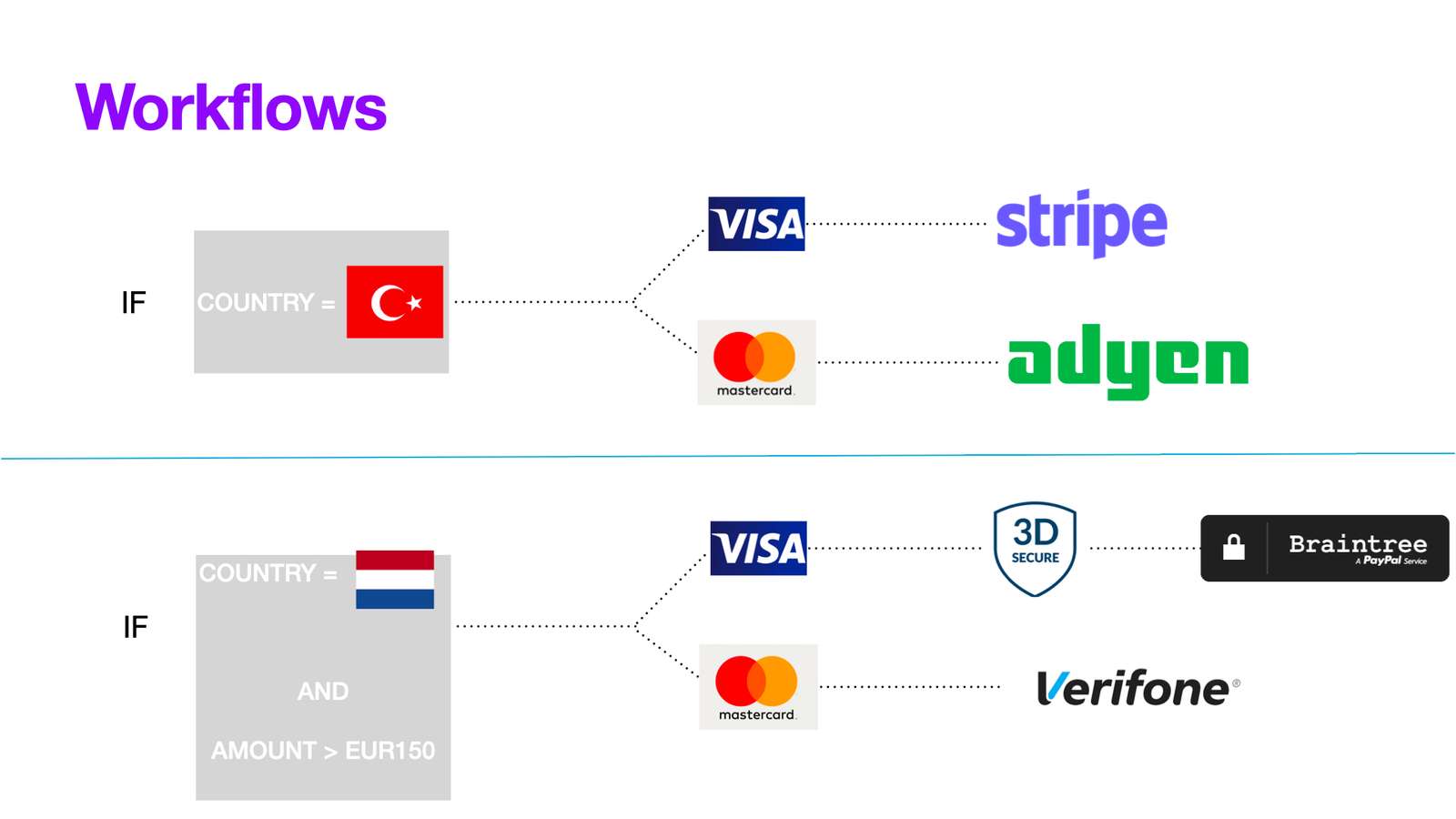

- Enable revenue teams to control payment flows without writing code

- Route payment flows based on type of transaction (method, currency, amount, fraud detection etc)

- Offer direct integrations

- Offer standardised checkout page

Just imagine to control something like this using UI within browser rather than writing hundreds of lines of code:

Some Players

Many startups have been experimenting, trying to match market-product fit etc. Some of them are:

1. Primer: Recently raised $50 million dollars in Series B. Primer, which was founded in 2020 by former Braintree colleagues Anthony and Gabriel Le Roux, allows merchants to plug in third-party payment solutions with one-click connections and integrations.

2. Gr4vy : Recently raised about $11million Series A and $15 Series extension funding and it claims to have doubled its valuation to $115million. "Gr4vy is the only payment orchestration platform built natively in the Cloud giving you scale and control of your payment stack from anywhere."

3. Spreedly: Probably one of the first payment orchestration firms. Spreedly has hundreds of customers and looks very promising.

4. Wowpay: New & promising player focussed more on Asia Pacific integrations and payments and focus on airlines.

Conclusion:

I believe there's opportunity and market for many PoPs to bring real value to online merchants. And provide more features like payment analytics, intelligent routing using machine learning, fraud prevention, one-click payments etc.